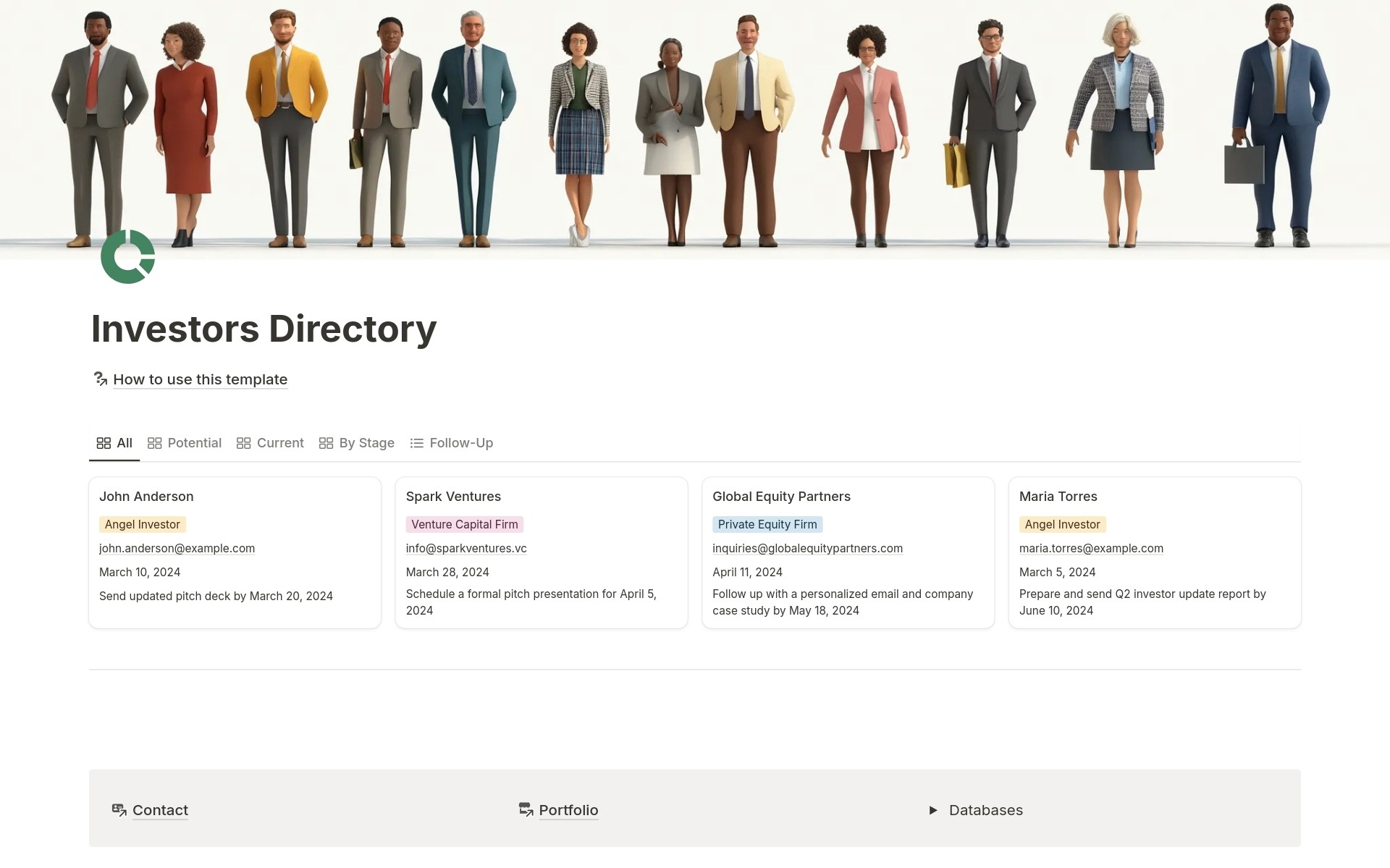

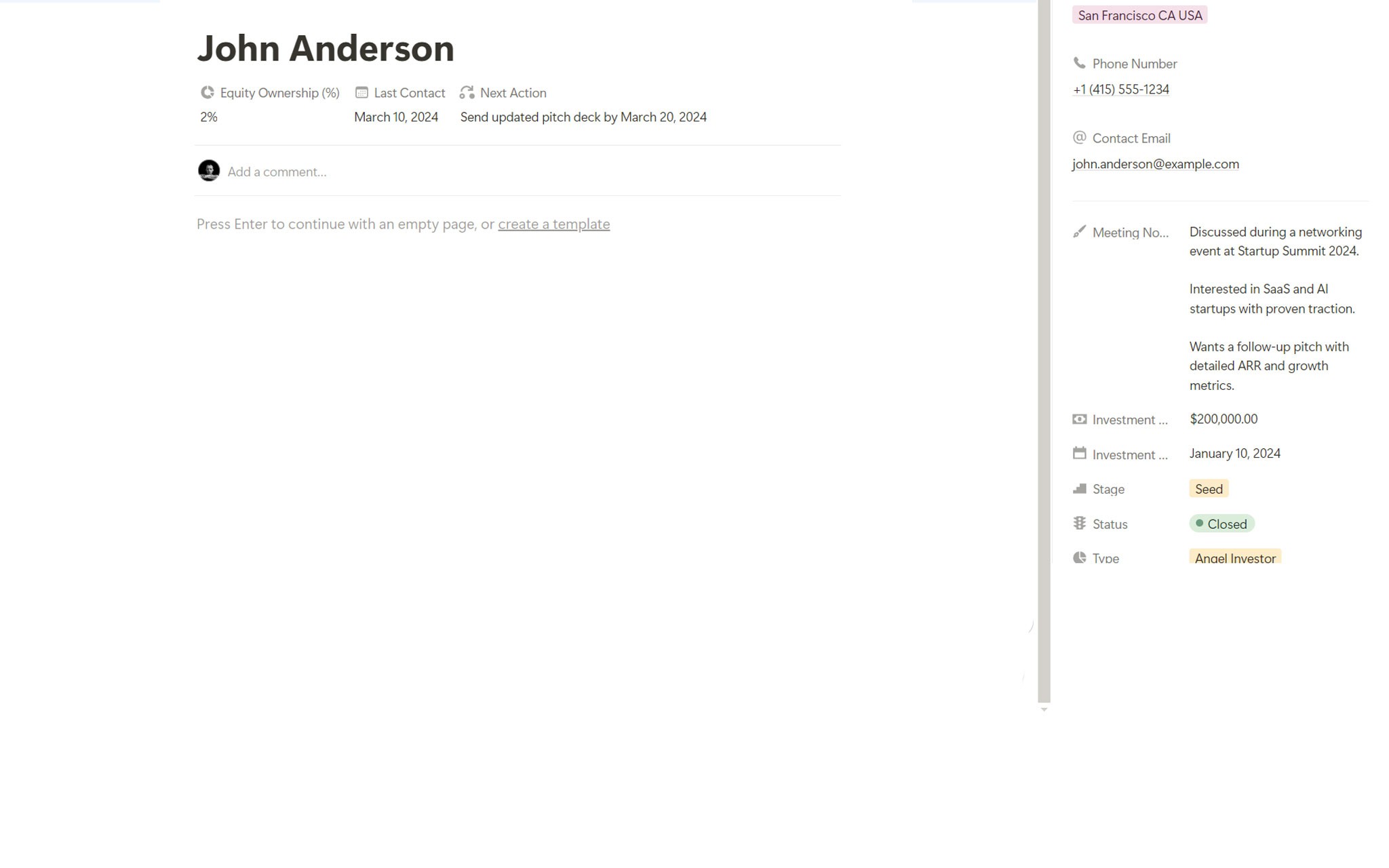

Investors Directory

Turn Investor Chaos into Capital Success.

The complete investor management system that helps founders track relationships, manage fundraising pipelines, and close deals without scattered spreadsheets and missed follow-ups.

Raising capital is already hard enough. But managing dozens of investor conversations across spreadsheets, email threads, and sticky notes? That's where deals fall apart. You forgot to follow up with a warm lead. You can't remember what you discussed in your last meeting. You lose track of who's interested, who's committed, and who's gone quiet. Critical fundraising momentum dies because your system can't keep up.

- Investor contacts scattered across email, LinkedIn, and random notes - No clear view of where each investor stands in your pipeline - Missed follow-ups because dates aren't tracked systematically - Can't remember meeting discussions or next steps - No organization by investment stage or investor type - Spreadsheets that become outdated the moment you close them - Lost opportunities because relationships weren't nurtured properly

Investors Directory transforms your fundraising chaos into a systematic relationship management engine where every conversation, follow-up, and commitment is tracked automatically. Instead of hunting through emails and hoping you remember details, you see your complete investor pipeline with contact information, meeting notes, investment amounts, follow-up dates, and relationship status in one organized system. Smart views automatically show you who needs attention, who's committed, and where your funding stands.

What´s Included

How It Works

In less than 30 minutes, you'll have a complete investor relationship management system that ensures nothing falls through the cracks.

Key Features

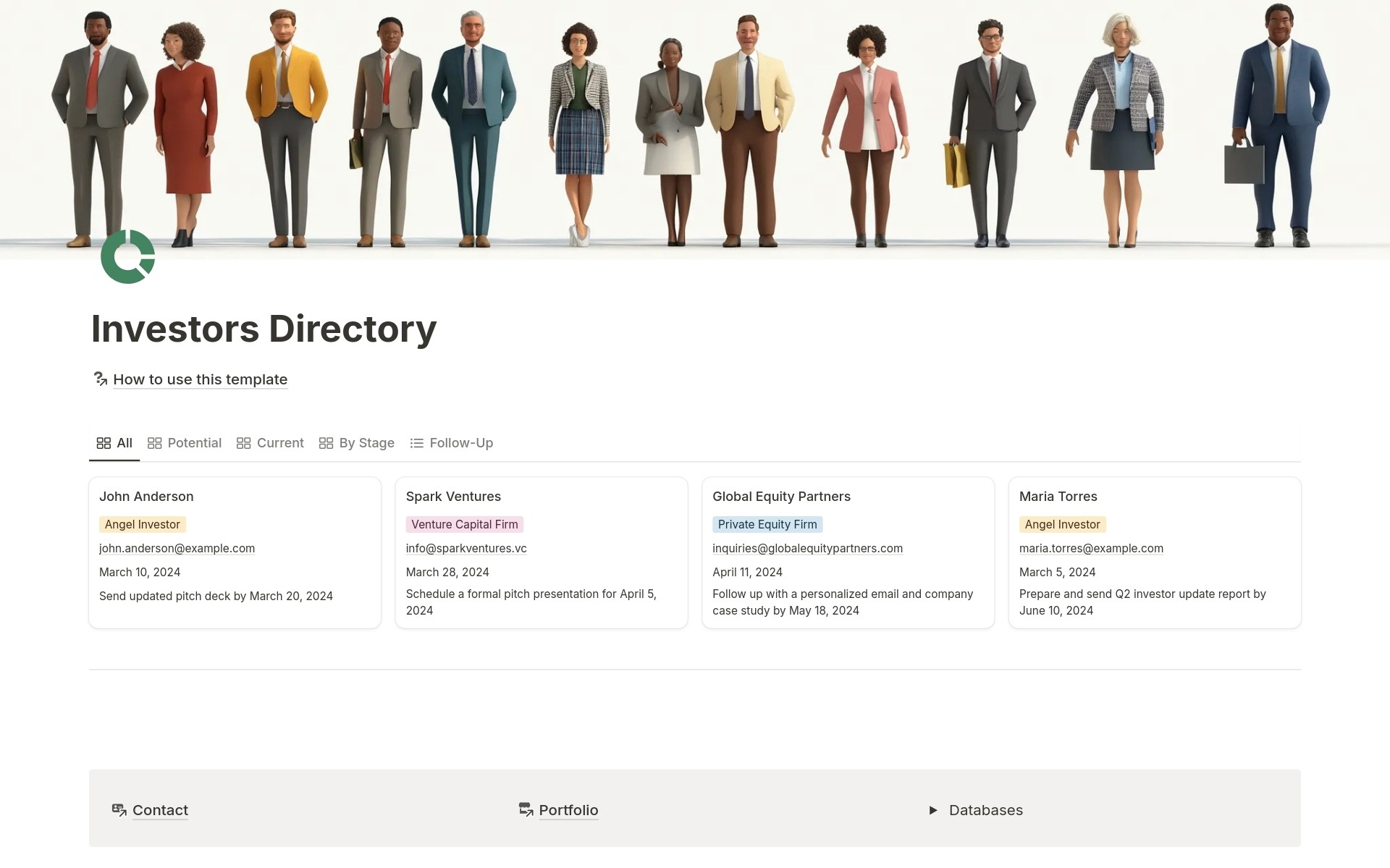

Complete Investor Profiles

Multi-Dimensional Investor Tracking

Capture investor type (VC firm, angel investor, individual, PE firm), location, contact information, and investment preferences in structured profiles. When you need to segment your outreach by investor type or location, filter instantly instead of manually sorting spreadsheets.

Investment History Documentation

Record investment dates, amounts with automatic currency formatting, and equity ownership percentages. Your cap table data stays organized and you always know who owns what stake in your company.

Meeting Notes That Actually Get Used

Document every investor conversation with rich text notes. Record their questions, concerns, interests, and feedback so you never walk into a follow-up meeting unprepared or repeating yourself.

Pipeline Management

Visual Status Workflow

Track each investor's journey from Prospective through Contacted, Interested, Committed, and finally Closed. See exactly where every relationship stands and identify bottlenecks in your fundraising funnel.

Stage-Based Organization

Tag investors by funding stage: Pre-Seed, Seed, Series A, B, C, D, Growth, IPO, or specialized stages like Strategic or Buyout. Filter to focus on stage-appropriate investors and avoid wasting time on mismatched conversations.

Multi-Stage Investor Tracking

Some investors participate in multiple rounds. Multi-select stage tags let you track investors who've invested in Seed and Series A, or who you're targeting for both current and future rounds.

Follow-Up Management

Never Miss a Follow-Up Again

Set follow-up dates for each investor and view them sorted chronologically in the Follow-Up view. Your most urgent investor conversations appear at the top automatically so warm leads never go cold.

Last Contact Tracking

Record when you last spoke with each investor. Identify relationships that have gone quiet and need re-engagement before they lose interest completely.

Next Action Clarity

Document specific next steps for each investor—"Send deck," "Schedule partner meeting," "Provide updated financials," "Follow up after Q3 results." Everyone on your team knows exactly what needs to happen next.

Smart Views for Every Need

All Investors Gallery

See your complete investor network in a visual gallery with names, types, contact information, and next actions. Perfect for team meetings or when you need the full picture of your fundraising landscape.

Potential Investors Focus

Automatically filters to show only Prospective, Contacted, Interested, and Committed investors—your active pipeline. Hide closed deals and inactive relationships so you focus energy where it matters.

Current Investors View

See only investors who've closed and funded your company. Use this view to manage investor relations, prepare updates, and identify potential follow-on investors for future rounds.

Financial Intelligence

Investment Amount Tracking

Record exact dollar amounts each investor has committed or contributed. Automatic currency formatting keeps numbers clear and professional.

Equity Ownership Calculation

Track ownership percentages for each investor. Essential for cap table management, understanding dilution, and making informed decisions about future rounds.

Round-by-Round Analysis

Filter by stage to see total investment by round. Understand how much you've raised in Seed versus Series A, and plan future fundraising accordingly.

Relationship Intelligence

Contact Information Hub

Store email addresses and phone numbers for every investor relationship. When it's time to reach out, you're one click away from the information you need.

Location-Based Networking

Track investor locations with preset cities (San Francisco, New York, London, Miami) or add your own. Schedule in-person meetings when you're traveling to investor hubs.

Inactive and Exited Investor Tracking

Mark investors as Inactive when they stop responding or Exited when they've sold their stake. Keep historical records without cluttering your active pipeline.

Perfect For

Startup Founders

Raising Pre-Seed, Seed, or Series A funding and need a professional system to manage investor relationships without expensive CRM software.

Early-Stage Companies

Building investor networks while running the business, and need efficiency in tracking dozens of conversations simultaneously.

Solo Founders

Managing the entire fundraising process alone and can't afford to let relationships or follow-ups slip through the cracks.

Founding Teams

Coordinating investor outreach across multiple co-founders and need shared visibility into who's talking to whom and what was discussed.

Pre-Revenue Startups

Focused on raising capital as a primary activity and need systematic relationship management to improve close rates.

Growth-Stage Companies

Managing relationships with existing investors while cultivating new ones for follow-on rounds.

Stop Losing Deals. Start Closing Capital.

Investors Directory tracks every relationship with status pipelines, prioritizes follow-ups by date automatically, organizes investors by stage and type, and documents every meeting detail so warm leads never go cold, and you never walk into conversations unprepared. Are you ready to stop losing fundable deals to disorganization and start managing your fundraising pipeline like the systematic operation it needs to be?